Carbon Tax

CARBON TAX

Singapore’s carbon tax forms part of Singapore’s comprehensive suite of mitigation measures to support the transition to a low-carbon economy. It provides an effective economic signal to steer producers and consumers away from carbon-intensive goods and services, hold businesses accountable for their emissions, and enhance the business case for the development of low-carbon solutions. About 80% of our total greenhouse gas (GHG) emissions are covered by carbon tax and fuel excise duties on our transport fuels. Of our emissions, around 70% are covered by the carbon tax levied on about 50 facilities in the manufacturing, power, waste, and water sectors. This coverage is one of the most comprehensive globally.1

Carbon Tax in Singapore from 2019 to 2023

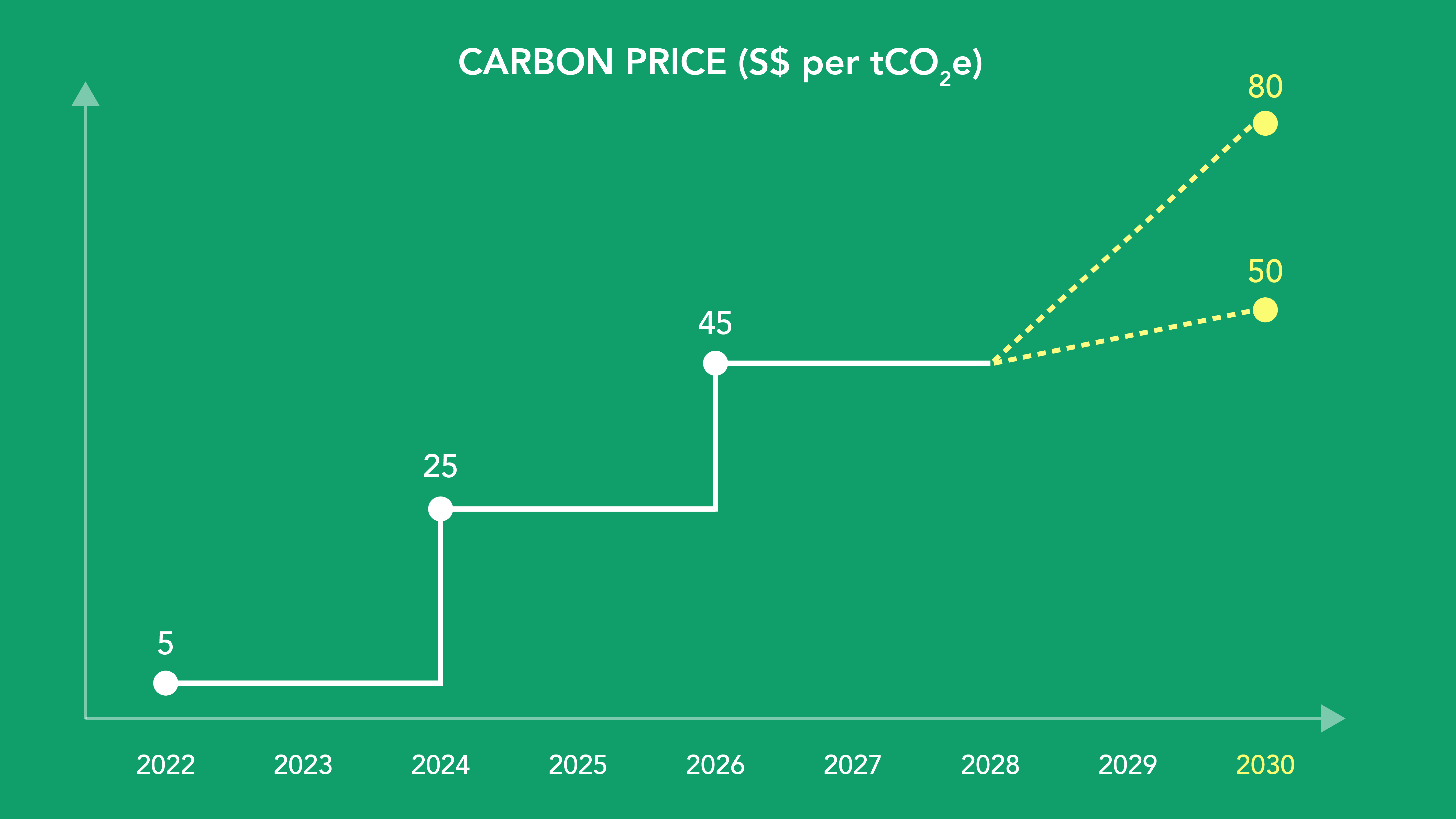

Singapore implemented a carbon tax, the first carbon pricing scheme in Southeast Asia, on 1 January 2019. The carbon tax level was set at S$5/tCO2e for the first five years from 2019 to 2023 to provide a transitional period for emitters to adjust.

Key Updates to Singapore's Carbon Tax from 2024

To support our net zero target, the carbon tax was raised to S$25/tCO2e with effect from 2024. It will be raised to S$45/tCO2e in 2026 and 2027, with a view to reaching S$50-80/tCO2e by 2030. This will strengthen the price signal and impetus for businesses and individuals to reduce their carbon footprint in line with national climate goals.

The revised carbon tax trajectory is critical in enabling the pace of transformation needed to achieve our raised climate ambition and make the economy- and society-wide transition to a low-carbon future. It also helps businesses remain competitive in a low-carbon future, by enhancing the business case to invest in low-carbon solutions, and ensuring that new investments and economic activities are aligned with our national climate goals.

The Government does not expect to derive additional net revenue from the carbon tax increase in this decade. The revenue will help to fund measures that support decarbonisation efforts and the transition to a green economy, and cushion the impact on businesses and households.

Use of International Carbon Credits

Companies may use high quality international carbon credits (ICCs) to offset up to 5% of their taxable emissions from 2024. This will cushion the impact for companies that are able to source for eligible carbon credits in a cost-effective manner, help to create local demand for high-quality carbon credits, and catalyse the development of well-functioning and regulated carbon markets. Eligible ICCs used under the carbon tax regime will need to comply with rules under Article 6 of the Paris Agreement, and meet seven principles to demonstrate high environmental integrity. More details can be found at Singapore’s Carbon Markets Cooperation website.

Transition Framework

The government has introduced a transition framework to provide support for emissions-intensive trade-exposed (EITE) companies as they work to reduce emissions and invest in cleaner technologies, while managing the near-term impact on business competitiveness. The framework will also help to mitigate the risk of carbon leakage.

The amount of allowances awarded to each facility is determined based on its performance on internationally-recognised efficiency benchmarks where available, and the facility’s decarbonisation plans. These transitory allowances are limited to only a portion of companies’ emissions, and the amount awarded to eligible facilities will also be reviewed regularly. New investments will not qualify for the transition framework. Similar frameworks have been implemented in other jurisdictions with carbon pricing schemes, including the EU, South Korea, and California.

FAQs

1. Who is covered under the carbon tax?

The carbon tax is levied on facilities that directly emit at least 25,000 tCO2e of greenhouse gas (GHG) emissions annually. It currently covers seven GHGs, namely carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6), and Nitrogen Trifluoride (NF3).

About 80% of our total GHG emissions are covered by carbon tax and fuel excise duties on our transport fuels. Of our emissions, around 70% are covered by the carbon tax levied on about 50 facilities in the manufacturing, power, waste, and water sectors. This coverage is one of the most comprehensive globally. Facilities in other sectors also indirectly face a carbon price on the electricity they consume as power generation companies are expected to pass on some degree of their own tax burden through increased electricity tariffs.

2. How are emissions-intensive trade-exposed (EITE) sectors determined? Why is there a need for the transition framework for EITE sectors?

EITE sectors face a higher risk of carbon leakage, where companies relocate to other jurisdictions with less stringent climate policies as a result of intense competition in the global market. Examples of EITE sectors include chemicals, electronics and biomedical manufacturing sectors, while non-EITE sectors include domestic-oriented sectors like power generation and waste management.

As the Government raises the carbon tax, companies in EITE sectors may face higher costs than their counterparts in jurisdictions with no or lower effective carbon prices. These companies contribute a significant number of jobs and value-added to our economy. Some will require more time to make the necessary reduction in emissions or investment in cleaner technologies. By providing for a transition framework, the Government seeks to alleviate the near-term impact on business competitiveness and minimise the risk of carbon leakage.

To encourage decarbonisation, transitory allowances are provided for only a portion of companies’ emissions. Similar frameworks have been implemented in other jurisdictions with carbon pricing schemes, including the EU, South Korea, and California.

3. Which other countries or jurisdictions have implemented carbon pricing?

Carbon pricing has been implemented in many countries, with more planning to implement them in the future. There are 75 carbon pricing instruments in operation (1 regional, 43 national and 31 subnational jurisdictions), covering about a quarter of global greenhouse gas emissions in 2024.2 A few of these jurisdictions such as Finland, Norway and Sweden have implemented carbon pricing as early as the 1990s. Jurisdictions in our region that have announced plans to price carbon and introduce new carbon regulations include Thailand and Brunei.

4. How will the increased carbon tax levels affect individuals and households? What support will be available to households, especially low-income households, to cope with the rising cost of living from the carbon tax increase?

Although the carbon tax is directly levied upstream on large emitters, it could flow through in the form of higher electricity tariffs as power companies pass on the carbon tax to end users. On average, with every $5/tCO2e increase in the carbon tax level, electricity tariffs could rise by around 1%. The increase in carbon tax to $25/tCO2e is estimated to translate to an increase of about $4 per month in household utility bills for the average 4-room HDB flat.

The carbon tax is needed to put a price on the externality or social cost of carbon. In doing so, it shapes the behaviour of individuals and households to reduce their energy consumption and be more energy efficient, to enable us to meet our long-term commitments. Notwithstanding, the Government is committed to help Singaporean households cope with the rising cost of living, whether this is driven by carbon tax or other factors.

As announced at Budget 2024, additional U-Save rebates will also be disbursed as part of the enhanced Assurance Package to help HDB households cope with the increases in utility bills. Eligible HDB households will receive 2.5 times the amount of regular GSTV – U-Save, or up to $950, in the 2024 financial year.

5. How would the Government ensure that consumers are not over-charged by electricity retailers passing on more than 100 per cent of the carbon tax to consumers?

Today’s electricity retail market is competitive and discourages retailers from raising their electricity rates excessively. Nevertheless, the Energy Market Authority will continue to ensure fair and efficient conduct of market players. Government agencies will also work closely with the Consumer Association of Singapore and Competition & Consumer Commission of Singapore to monitor the market for unfair pricing and coordinated price hikes which are anti-competitive.

6. Why are we allowing carbon tax liable facilities to offset only up to 5% of their emissions using international carbon credits from 2024?

The facility-level limit has been set at 5% to ensure that the industry continues to prioritise domestic emissions reduction, while providing an additional decarbonisation pathway for hard-to-abate sectors that may find it challenging to significantly cut emissions in the near to medium term. This limit is aligned with other comparable jurisdictions with similar climate ambitions, such as South Korea and California. We will continue to review the facility-level limit overtime to align with international developments.

1 Singapore’s carbon tax covered around 80% of our total national emissions at the point of introduction. The coverage each year is subject to changes in emissions from taxable and non-taxable sources that constitute Singapore’s GHG inventory. In November 2024, we formalised our accounting methodology for hydrofluorocarbon (HFC) emissions from the Refrigeration and Air Conditioning (RAC) sector and included these emissions in our GHG inventory, in accordance with the United Nations Framework Convention on Climate Change (UNFCCC) and Intergovernmental Panel on Climate Change (IPCC) guidelines. Due to this rebasing, Singapore’s carbon tax coverage for 2022 emissions fell to around 71% from 76%. The Singapore government has implemented measures since 2020 to reduce GHG emissions from the use of HFC refrigerants in the RAC sector, such as banning the supply of RAC equipment that use high Global Warming Potential refrigerants. We will continue to review our RAC HFC mitigation policies to ensure they remain fit for purpose and effective in meeting our climate targets.

2 Based on World Bank’s Carbon Pricing Dashboard as of Jan 2025.